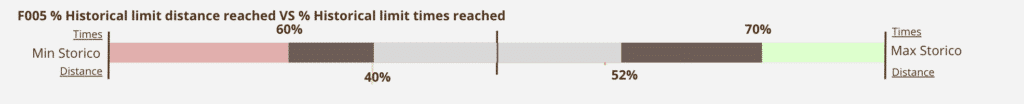

The charts illustrate the connection between the percentage distance of the price from the historical limits and the percentage of lows or highs reached. The bar chart, for example, highlights scenarios where a price that has reached only 40% of its historical peak might have covered 99% of historical cases.

The charts incorporate seven key values:

This analysis provides traders with an in-depth view of the relationship between current and historical price behavior, enhancing the trading strategy.

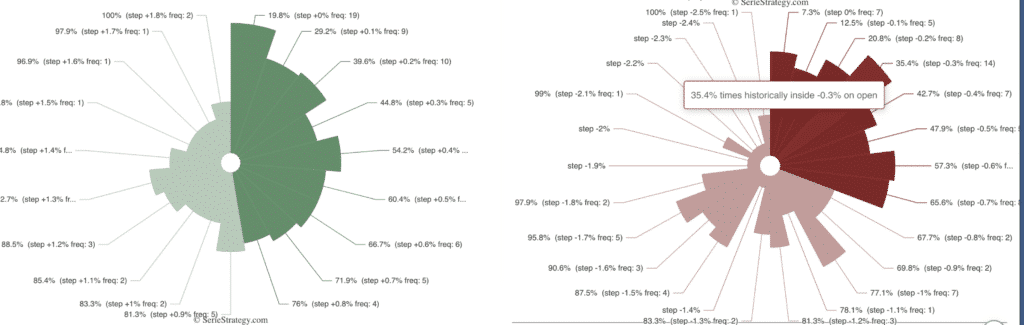

The “wheel” charts offer a view of the historical frequency of limits within a certain range, highlighting how many of these limits have already been reached in the current period.

The provided examples demonstrate how this data can influence trading decisions, offering a statistical context to evaluate potential future moves. While statistics cannot predict the future, they provide traders with valuable information to optimize their decisions. And as always, a well-informed trader has a higher chance of success.

These charts relate the distance reached by the price from the historical limit (100%), minimum, and maximum, with the percentage of the number of minima (or maxima) reached. The bar chart is useful, for example, to note that even if a price has reached only 40% of the historical maximum, it may have already reached 99% of historical cases.

The chart effectively represents 7 values:

This information is useful to traders as it clearly shows the relationship of the current price behavior to its historical behavior. Combining this information with the other data you use to define your exit strategy for a trade can make a difference.

The two “wheel” charts show the historical frequency of a limit occurring within a specific range (step) of distance and highlight how many of those limits have already been reached by the price in the current period.

Usage example: Imagine, for instance, having made a profit due to an unexpected +1.5% in your Day Trading operation; the question you’d ask yourself at that moment is: when should I exit? Thanks to an analysis like this, you can discover that even though the price has risen more in the past, the number of times it has happened is minimal compared to the times the price has pulled back. You would discover, for example, that from a statistical standpoint, your trade has already given everything, and it’s probably better to close the trade.

Imagine you have opened a short position, now imagine that the price drops by 1.1%, and you are wondering if you should wait to see if it drops further or not. This chart indicates that the historical maximum limit is -4.5% and that you have currently surpassed only 40% of the historical lows achieved in the past. This means that in the past, 60% of the time it went even lower than 1.1%.

These analyses can never predict what will happen shortly, statistics don’t allow for it, but we are sure that in that situation you would prefer to have this additional information before making a decision. An informed trader is statistically more successful.