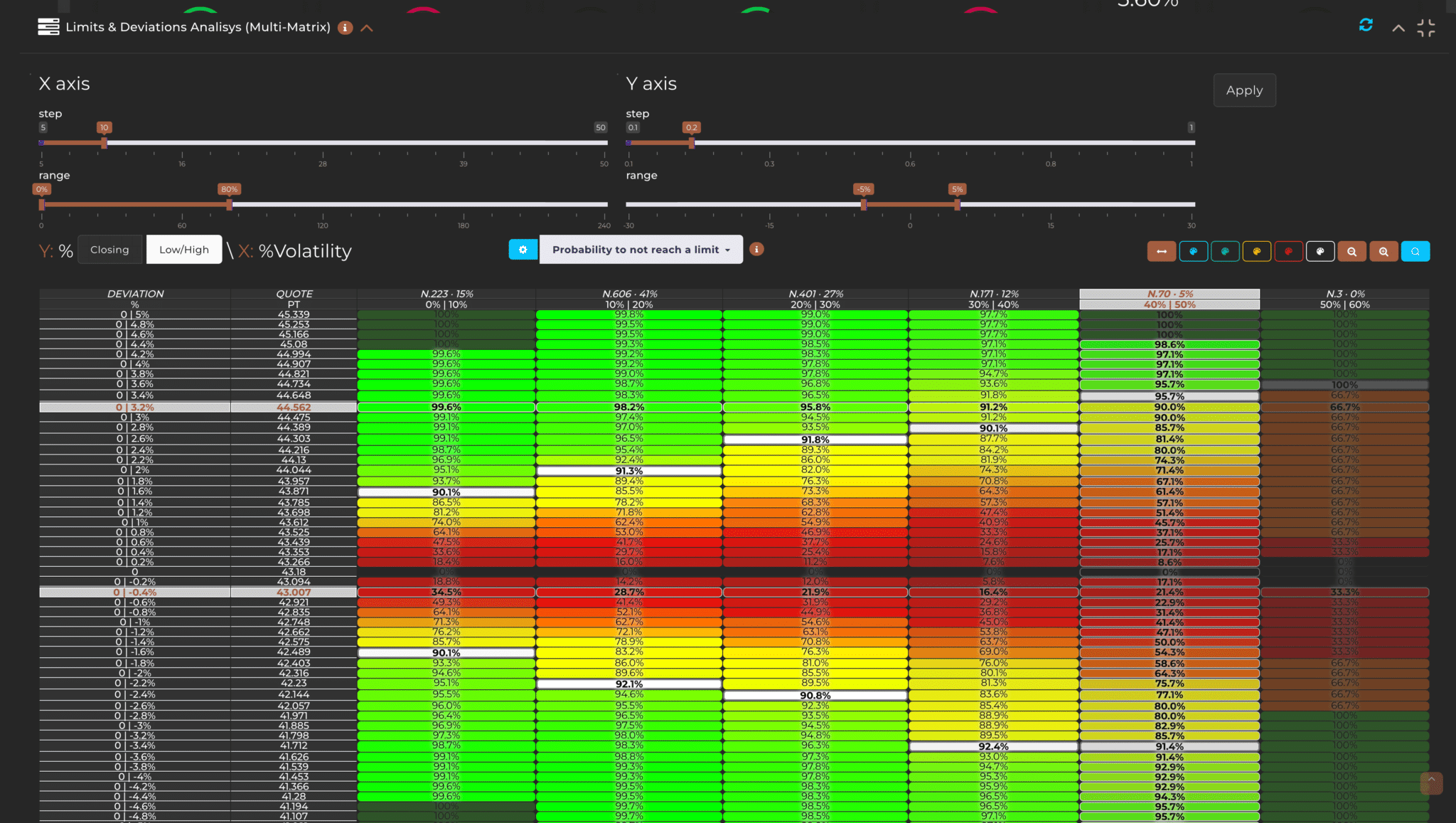

Welcome to MetricAlgo’s exclusive tutorial on our Multi-Metric Matrix, a true revolution in financial market analysis. This sophisticated tool is designed to provide users with a deep and detailed understanding of historical probabilities and distributions of deviations from minimum, maximum, and closing limits. Every calculated data is meticulously organized, following specific metrics, with a particular focus on volatility, to accurately reflect the candle count in the filtered series.

The beating heart of this feature is a combination of interactive and intuitive components:

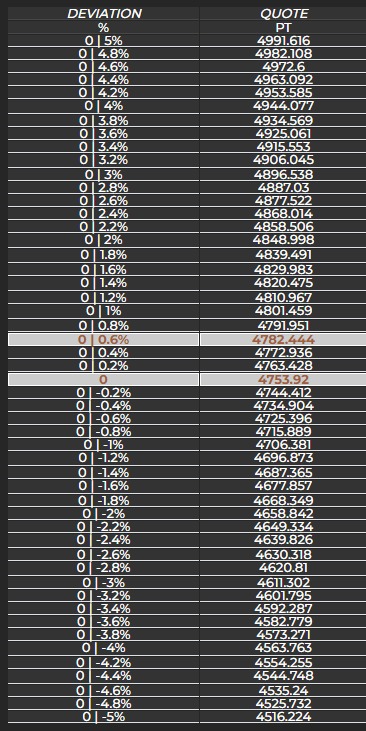

Let’s analyze the table structure:

Volatility is the main feature on the X-axis, represented as a percentage, with columns that divide volatility into ranges from 0-10%, 10-20%, and so on. We are already working to integrate other clustering metrics, increasing the versatility of the matrix. Imagine the same matrix showing probabilities, frequencies, and distributions organized by opening gap ranges or other relevant metrics.

Each column title provides a detailed count and percentage of historical cases where volatility, at the opening of the candle, was within a specific range. The sum of these values represents the total number of candles analyzed in the filtered series.

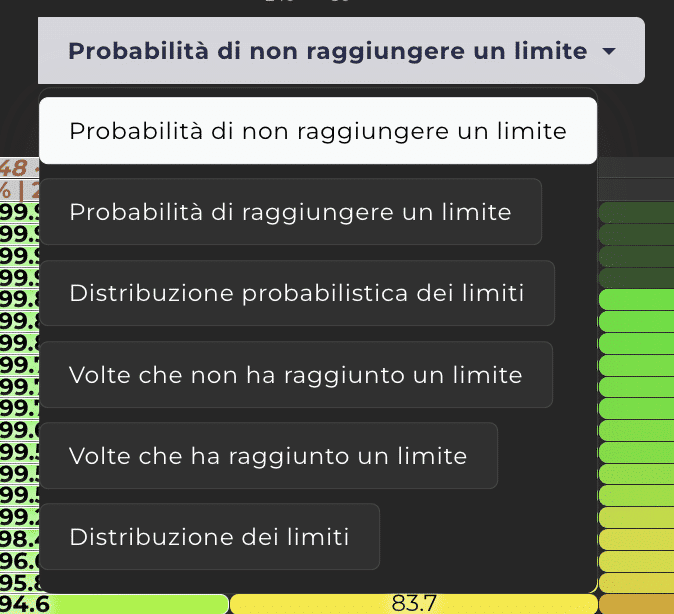

The Multi-Metric Matrix offers six distinct visualization modes, each providing a unique perspective on market dynamics:

Each visualization provides a clear and accurate picture of probabilities and historical cases, helping you to better understand market movements. For example, the visualization of the probabilities that a limit will not be reached provides incremental percentages based on the total number of cases for each column. This helps you to quickly evaluate the probability of a particular deviation from occurring or not.

Hovering over each cell reveals frequency or probability values, providing additional depth of analysis. Colors, which you can customize, play a crucial role in representing the progression of data, with options to invert the color scale or add an exotic touch.

This tutorial is designed to walk you through every aspect of MetricAlgo’s Multi-Metric Matrix, highlighting its unique features and the value it can bring to your market analysis. We hope that this guide helps you to make the most of this advanced tool and contributes to enhancing your trading strategy.