A trend is a directional movement of the price of a financial asset over time, representing the general market orientation.

Trends can be divided into three main categories: bullish, bearish, and sideways. Understanding trends is essential for technical analysis and for formulating effective trading strategies.

Bullish Trend: A bullish trend occurs when the prices of an asset move upward over time, creating higher highs and higher lows. In this case, demand exceeds supply, leading to a price increase. Traders often seek to buy in a bullish trend, anticipating further price rises.

Bearish Trend: A bearish trend occurs when the prices of an asset move downward over time, creating lower highs and lower lows. In this scenario, supply surpasses demand, leading to a price decrease. Traders often look to sell or short-sell in a bearish trend, anticipating further price declines.

Sideways Trend: A sideways trend, also known as a consolidation market, occurs when the prices of an asset oscillate within a limited range without showing significant directional movement. In this case, supply and demand are in balance, and the price remains stable. Traders often use range trading strategies in a sideways market, trying to buy at support levels and sell at resistance levels.

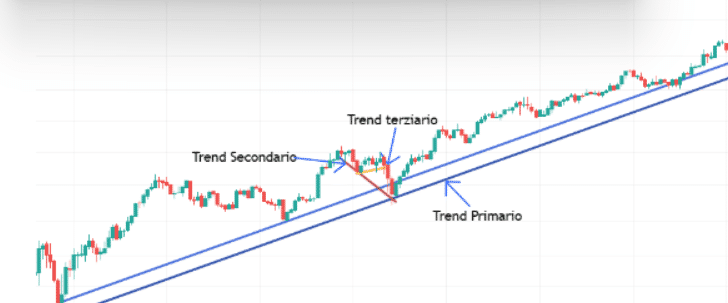

In addition to these three main categories, trends can be subdivided based on their duration:

Primary Trends: These trends develop in the long term, usually from a few months to several years, and represent the main directional movement of the market.

Secondary Trends: These trends develop in the medium term, usually from a few weeks to several months, and represent corrections or counter-movements to the primary trend.

Tertiary Trends: These trends develop in the short term, usually from a few days to several weeks, and represent minor fluctuations within secondary trends.

It is essential for traders to understand trends and their characteristics to identify trading opportunities and manage risk effectively.

Identification of Trend Lines

Trend lines are graphical tools used in technical analysis to identify and visualize trends in the market. They are lines drawn on price charts connecting key points such as relevant highs and lows. Trend lines help traders recognize the market direction, identify potential reversal points, and formulate trading strategies.

Here’s how to correctly identify trend lines:

Select appropriate points: To draw a trend line, you first need to identify significant points on the price chart. For a bullish trend, connect successive lows; for a bearish trend, connect successive highs. In general, at least two points are needed to draw a trend line, but three or more points provide greater validity and reliability.

Connect the points: Using charting software or a trading platform, connect the selected points with a straight line. The trend line should touch as many lows (in a bullish trend) or highs (in a bearish trend) as possible, although it’s normal for the price to briefly cross the line in some cases.

Extend the trend line: Once drawn, extend the trend line into the future to visualize possible support or resistance levels and anticipate potential reversal points. Keep in mind that trend lines are not static and may need to be updated as new price action develops.

Evaluate the strength of the trend line: A steeper trend line suggests a stronger price movement, while a less steep trend line indicates a weaker trend. Additionally, a trend line with numerous points of contact extending over a longer period is generally considered more reliable and significant.

Rules and best practices: When drawing trend lines, it’s important to follow some rules and best practices to ensure accurate and useful results:

Use a logarithmic scale for long-term charts, as it takes into account percentage changes in prices rather than absolute changes. Pay attention to the frequency of contacts between the price and the trend line: a trend line with more contacts is generally considered stronger and more reliable. Avoid forcing trend lines to fit price action; trend lines should be drawn objectively to accurately reflect market trends. Learning to correctly identify trend lines and use them in technical analysis can provide valuable insights into market direction, helping traders make more informed trading decisions and manage risk effectively.

Types of Trend Lines

Trend lines are an essential tool for analyzing market trends and predicting future price behavior. There are several types of trend lines that traders can use to gain different insights into the market. In this section, we will delve into the different types of trend lines, such as horizontal, diagonal, and curved lines, and explain how to use them to identify support and resistance levels and predict potential trend reversals.

Horizontal Trend Lines: Horizontal trend lines are lines parallel to the x-axis (X-axis) and are used to identify static support and resistance levels. Support is a level below which the price has difficulty falling, while resistance is a level above which the price has difficulty rising. Horizontal trend lines are drawn by connecting previous lows and highs and can help traders identify potential price reversal areas and entry or exit points from the market.

Diagonal Trend Lines: Diagonal trend lines are inclined lines used to identify and follow bullish and bearish trends. In a bullish trend, the diagonal trend line is drawn by connecting successive lows, while in a bearish trend, it is drawn by connecting successive highs. Diagonal trend lines provide dynamic support levels (in a bullish trend) or dynamic resistance levels (in a bearish trend) and can indicate the intensity of the trend and potential reversal points when they are broken.

Curved Trend Lines: Curved trend lines, also known as regression lines or regression channels, are flexible lines that follow the overall trend of prices and try to adapt to market oscillations. These lines can be used to identify long-term trends and dynamic support and resistance levels. Curved trend lines may be more difficult to draw than straight lines, but they offer a more accurate representation of complex trends and volatile price movements.

Using trend lines to identify support and resistance levels and predict potential trend reversals.

Support and Resistance: Trend lines can help traders identify support and resistance levels, which represent areas where the price has difficulty breaking through. Identifying these levels can provide trading opportunities and information about possible future price behavior.

Trend Reversals: When the price breaks a significant trend line, it may indicate a change in the direction of the trend and a potential reversal. Traders can use this information to enter or exit positions, set stop-loss orders, and adjust their trading strategies based on new market developments. Confirmation of Reversals: Before considering a trend line breakout as a reversal signal, it’s important to wait for confirmation. This may include increased trading volume, a significant candlestick close outside the trend line, or an intersection with other technical indicators. Confirmation can help avoid false signals and enhance the reliability of predictions based on trend lines.

In summary, knowing and using different types of trend lines is essential for technical analysis and formulating effective trading strategies. Horizontal, diagonal, and curved trend lines offer a variety of information about market behavior, including trend direction, support and resistance levels, and potential reversal points. By using this information, traders can make informed decisions and manage risk more effectively.